96.7% of Bitcoin in Profit Amid Institutional Demand

- Bitcoin profitability hits 96.7% amid institutional demand.

- Higher profitability linked to ETF inflows.

- Potential for heightened volatility near term.

Greater Bitcoin profitability presents both growth opportunities and volatility risks, echoing past market patterns amidst substantial institutional interest.

With Bitcoin’s profitability reaching an impressive 96.7%, a significant rise from 87% just a week earlier, the cryptocurrency markets are experiencing renewed attention. Institutional demand through spot Bitcoin ETFs and favorable macroeconomic conditions are principal drivers of this increase. Analysts like Stockmoney Lizards and Mags predict potential explosive moves, with forecasts reaching up to $200,000 by year-end. Institutions such as Bitwise Investment underline the impact of a declining US Dollar Index on Bitcoin’s recent performance.

“Bitcoin is about to break out of a multi-year channel…The next leg will be explosive.”

The current landscape shows substantial inflows into Bitcoin-focused ETFs, increasing overall demand. The cryptocurrency market is witnessing most holders in a profitable position above their cost basis. According to Bernstein Research, institutional demand has resulted in a notable shift in Bitcoin’s profitability, driven by expectations of continued SEC compliance and ETF approvals. Strong institutional engagement is reshaping market dynamics significantly.

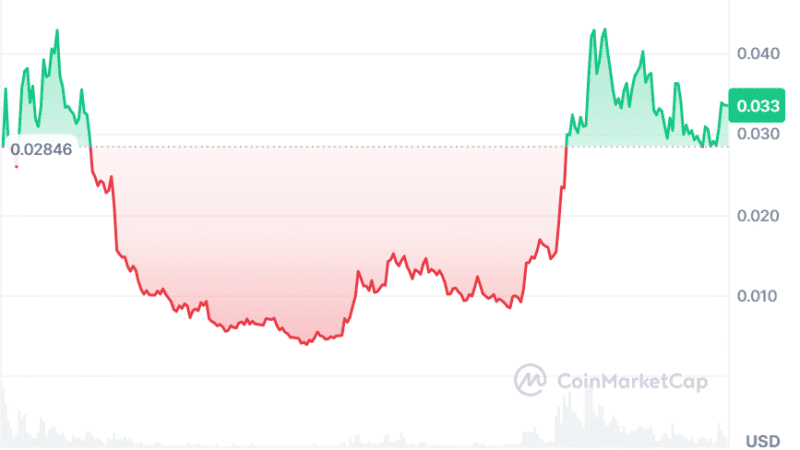

The high percentage of Bitcoin supply in profit can signal potential market tops or corrections. This mirrors historical patterns where profitability spikes have led to volatility. Financial analysts suggest that future market movements could see both explosive rallies and potential corrections. Past trends show that when over 95% of Bitcoin holdings are in profit, changes in market sentiment often occur quickly, affecting other cryptocurrencies.