Bitcoin Whale Transfers 2,520 BTC to Ethereum

- Historic BTC to ETH move by Bitcoin whale.

- Whale increases Ethereum holdings to 153,000 ETH.

- Market dynamics impacted across both assets.

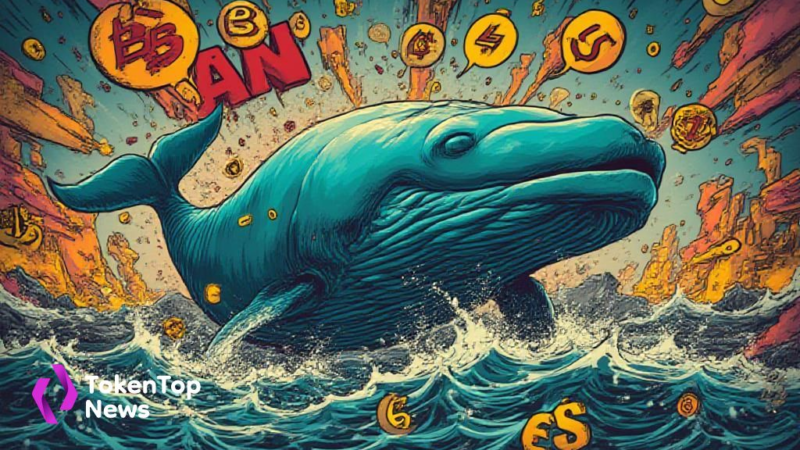

A dormant Bitcoin whale has moved 2,520 BTC, valued over $290 million, to Ethereum via Hyperliquid, increasing their ETH holdings to over 153,000.

The whale’s Bitcoin-to-Ethereum transfer affects both assets’ market dynamics, influencing market sentiment and sparking discussions among analysts and industry participants.

A prominent Bitcoin whale has recently converted 2,520 BTC to Ethereum, valued at over $290 million. This move was executed through Hyperliquid, where the whale’s newly acquired amount now totals over 153,000 ETH.

The whale, dormant for seven years, previously acquired the Bitcoin between 2017 and 2018. This decision signals a significant strategy shift from Bitcoin to Ethereum, capturing the financial community’s attention.

This transaction has placed immediate pressure on the Bitcoin market while causing bullish inflows to Ethereum. Analysts note a potential price consolidation for Ethereum around $2,550, speculating on a future breakout. “The movement of 2,520 BTC by a historic Bitcoin whale into ETH signals a strong strategic shift towards Ethereum,” remarked an analyst at AInvest.

The transfer’s magnitude affected both markets, prompting extensive discussions among analysts. Liquidity and trading activity have surged, particularly in the ETH/BTC trading pair, affecting overall market dynamics.

While official statements from key industry leaders or regulators have not surfaced, the transaction is heavily monitored by on-chain analysts. The community views it as an indicator of increasing trust in Ethereum’s potential.

Financial analysts speculate on potential long-term effects of this shift, considering historical precedents where similar asset movements led to market shifts. Ethereum developers and analysts are closely tracking this event for potential impacts on DeFi and staking flows.