BRC-20 tokens are going through the roof

Amazing developments are emerging in the Bitcoin ecosystem. The new token standard BRC-20, which was initially torn up as worthless, is going through the roof. Its total value could already rank 194th in the comparison of cryptocurrencies.

Bitcoin: BRC-20 tokens are going through the roof

The new token standard BRC-20 on Bitcoin will only start in March . As the name suggests, it is modeled on Ethereum’s ERC-20. The only problem: Without smart contracts, the Bitcoin token has no real use.

This is exactly why the inventor Domodata warned against using the BRC-20 standard right from the start. It is just a gimmick based on the Bitcoin Ordinals protocol. However, the user community does not seem to respect the will of the inventor.

In the meantime, almost 12,000 user-generated BRC-20 tokens have been created. According to the data aggregator Ordpace, 64 of these are more or less relevant. They have a market capitalization, while all other variants are worthless.

Ordi token is the leader of the leaderboard with a projected market cap of $74 million. It is trading at $3.52 and is up 41 percent on the 24-hour trend.

However, the number of users is already showing the first problems. Just around 4,700 holders share the tokens among themselves. The theoretical market capitalization of 74 million US dollars is therefore not very realistic.

If you add up the theoretical total value of all BRC-20 tokens, you get a total of currently 124 million US dollars. In the ranking of the largest cryptocurrencies, the token standard would thus take 194th place.

Tokens take up most of the blocks

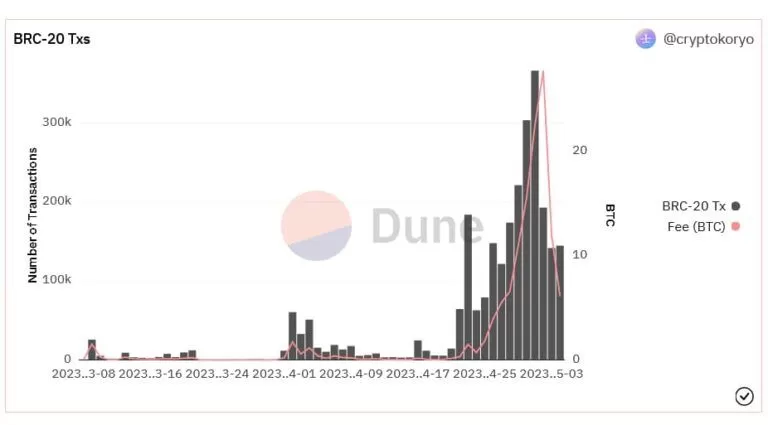

A look at the blockchain data makes it clear that BRC-20 tokens are not as irrelevant as one might first assume. Since the end of April, the activity of the token on the Bitcoin blockchain has exploded.

The previous record was set on May 1st. Around 366,000 transactions with BRC-20 tokens took place within one day. At the same time, the blockchain almost reached its peak with a total of 682,000 transactions. The Bitcoin blockchain can only process ~690,000 payments per day due to its low scalability.

Today, the number of BRC-20 transactions so far has stood at 144,000, data from Dune Analytics shows. The fees of the Bitcoin network developed parallel to the explosive adoption of the tokens.

Bitinfocharts and Ycharts recorded average network fees of up to $7 per transaction. Since its inception, users have paid a total of 124 BTC – i.e. 3.6 million US dollars – to send BRC-20 tokens.

Data from Dune shows that the soaring demand for BRC-20 tokens was responsible for the rapid increase in network fees. Accordingly, the fees have been decreasing since May 2nd.