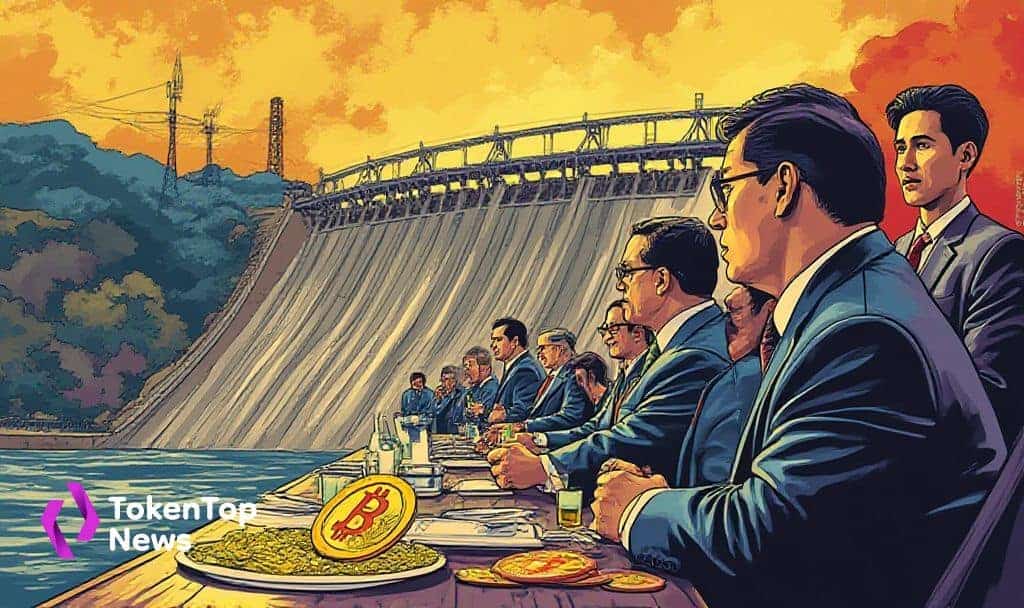

Paraguay Considers Strategic Bitcoin Reserve Using Hydropower

- Paraguay is exploring a national Bitcoin reserve utilizing hydroelectric power.

- Vice President leads the initiative, sparking economic discussions.

- No official financial allocation announced, potential market shifts noted.

Paraguay’s Vice President has initiated discussions on creating a national Bitcoin reserve using surplus hydroelectric power, aiming to follow global precedents like El Salvador, as reported by official sources.

The initiative may impact Bitcoin’s geopolitical dynamics, potentially attracting global financial attention, while the energy leveraged could redefine Paraguay’s economic strategy.

Paraguay is considering creating a strategic Bitcoin reserve by utilizing its surplus hydroelectric power. The initiative is driven by top government figures and is part of broader economic discussions. The announcement follows models set by El Salvador and Bhutan.

The effort is led by the Vice President of Paraguay, with key discussions involving industry leaders. Senator Salyn Buzarquis conducted research supporting this move. False reports of Bitcoin as legal tender were corrected by the presidency.

The potential reserve aims to utilize Paraguay’s surplus hydroelectric production, which significantly exceeds domestic needs. This initiative could transform energy usage and economic strategies in Paraguay, impacting various stakeholders in the region.

Although no specific funding details have been disclosed, discussions focus on mining Bitcoin using hydropower. The country’s major dams produced substantial energy, tripling local consumption, indicating a well-supported resource basis for such projects.

The proposed Bitcoin reserve has yet to affect global markets directly. The initiative remains under discussion with no policy enactment or allocation of funds seen. This approach follows global precedents with potential governance and economic impacts.

Insights into potential outcomes indicate financial, regulatory, and technological implications such as Bitcoin price volatility and IMF fiscal obligations being key considerations. Historical trends from countries like Bhutan influence Paraguay’s strategic direction. Senator Salyn Buzarquis remarked, “We are conducting a comprehensive analysis on the feasibility of integrating Bitcoin into our national strategy, focusing on the potential utilization of our energy resources.”