Bitcoin hashrate drops enormously – what’s behind it?

The Bitcoin hashrate has fallen dramatically over the last few days. In the weekly trend, the network’s computing power was a full 30 percent in the red at the time of going to press. Why the value is falling sharply and why Bitcoin miners are currently selling accumulated BTC.

Bitcoin hashrate drops enormously – what’s behind it?

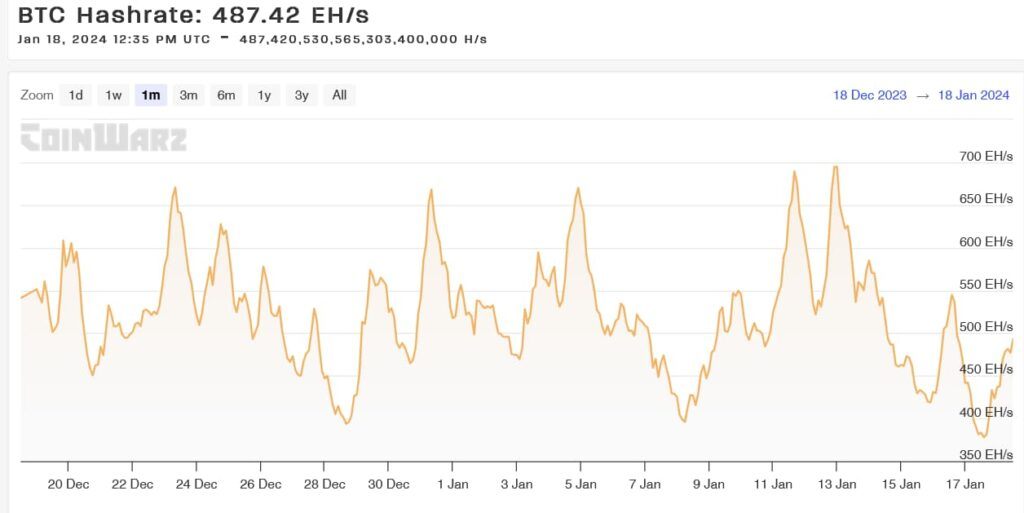

The hash rate of Bitcoin is falling massively. Various sources report a decrease in computing power of between 35 and 25 percent. At the time of going to press, the Bitcoin network combined a performance of 487 exahashes, as data from Coinwarz shows.

This corresponds to a decrease of 30 percent over the last seven days. As recently as January 13th, the Bitcoin hashrate was still at 695 E/Hs. Yesterday the network hit a low of around 380 exahashes. Despite remaining volatility, the network is recording a clear downward trend.

The decline in computing power is mainly due to orders from the US authorities. Last week they asked miners to limit their mining activities in order to relieve the strain on the power grid.

As temperatures drop, more and more households, especially in Texas, need more electricity to heat. The US state is known for its spacious areas and low electricity costs, which have made it the most popular location for Bitcoin miners.

Since yesterday, the hashrate has already increased again after the worst of the frost has been overcome. ERCOT , the managing authority of the Texas power grid, issued a weather warning in advance for the period from January 14th to 17th and as a result limited the utilization of Bitcoin miners.

Readers criticize the state of Bitcoin mining

On Twitter, some readers of recent reports about the decline in hashrate are criticizing the state of current Bitcoin mining. Some critics consider a blockchain whose miners have to obey the requirements of the state electricity administration to be too vulnerable.

Other critics consider the Bitcoin miners’ self-portrayal to be deceptive. These are careful to present themselves to the public as producers of electricity, even though they are using the majority of the power grid instead of strengthening it themselves.

Bitcoin mining is mostly carried out in mining centers, which are also known as Bitcoin farms. These are large facilities in which many ASICs are stored. The energy requirements of such facilities are enormous and can therefore be localized by authorities.

Mining centers are repeatedly shut down because authorities want to reduce the load on the power grid or due to unannounced mining activities. Data from the University of Cambridge also shows that miners repeatedly manage to evade government surveillance.

Despite the ban, a large part of the hashrate still comes from the People’s Republic of China. In January of this year, around 40 percent of the computing power came from China. The miners operate their activities through widespread decentralization from residential buildings or link their ASICs to electricity-intensive factories. So they remain underground.

Miners sell BTC reserves

There has also been a strong sell-off of BTC reserves by miners over the last few days. Since the summer of 2023, the companies have been accumulating Bitcoin, which they are now selling generously – Cointelegraph reports, citing data from CryptoQuant .

10,233 BTC worth around 450 million US dollars were sold yesterday, Wednesday. Since the accumulation in the summer, the Bitcoin price has almost doubled. Today it is trading at $42,300.

This is why miners made the decision to sell BTC. The realized profits can be used to cover ongoing operating costs while miners’ computing power plummeted.

Meanwhile, selling pressure is growing on Bitcoin and Co. The largest cryptocurrency is down 10.30 percent in the weekly trend.