Bitcoin fees rise to $40 per transaction.

Bitcoin BTC -1.57% continues to see sharp increases in network fees. The current values were last reached around two years ago. At that time, BTC was in the middle of a bull market. A special technology is currently creating a gold rush atmosphere.

Why are Bitcoin fees rising to $40 per transaction?

The network fees of Bitcoin are currently increasing massively. Yesterday, the average cost of a transaction rose to $38.40. The $40 mark was almost broken. At the time of going to press, the first improvements can already be seen. Currently, a transaction costs around eight US dollars. The enormous transaction costs have therefore not been completely averted.

At the time of going to press, around 90,000 transactions were still waiting for confirmation from the constantly busy Bitcoin network. The blockchain can only handle seven transactions per second.

Bitcoin yesterday recorded its most expensive network fees since April 2021, when an average transaction was at one point paying $63. This news is good news for miners who make additional profits from the high fees. However, the costs are annoying for end consumers.

Optimism in the crypto market is currently increasing. More transactions via Bitcoin are taking place. However, one specific application seems to be the last straw.

Ordinals put a strain on the network

It is still Ordinals that account for a large share of the utilization of the Bitcoin network. The protocol allows the creation of NFTs directly on Bitcoin, without the need for another layer.

Ordinals trading is currently exploding massively – so much so that the NFT marketplace of the centralized crypto exchange OKX is at the top of the industry, according to data from DappRadar emerges.

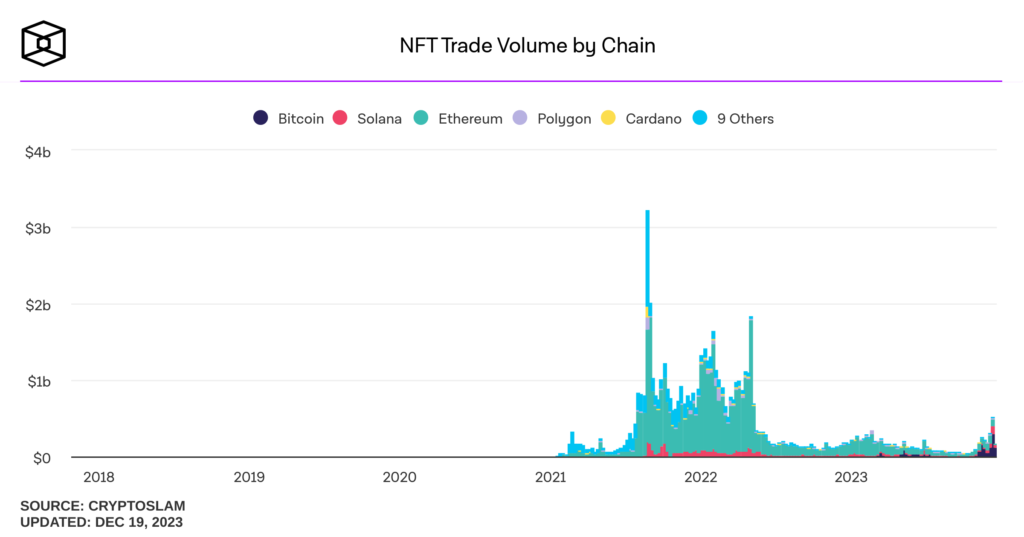

Bitcoin set a new record last month. For the first time, the trading volume of Bitcoin NFTs is larger than on the Ethereum ETH -0.92% blockchain. The non-fungible tokens began on ETH. Until now, the second largest blockchain was the undisputed leader in this area.

Slowly, however, the tide seems to be turning. Already since yesterday, Ordinals worth $74.40 million have been traded, according to data from The Block. In comparison, the values of Solana SOL -0.20% ($12.90 million) and Ethereum ($10.60 million) are noticeably low.

The conventional ordinals have recently been joined by more and more BRC-20 tokens. It is a fungible token standard based on Ordinals technology. Users can generate their own tokens on the Bitcoin blockchain.

There are now two BRC-20 tokens among the 100 largest cryptocurrencies: SATS (1000SATS) and ORDI (ORDI).

Why are ordinals going through the roof?

Neither Ordinals nor BRC-20 tokens have technical advantages that justify a particular benefit. Instead, the BRC-20 tokens benefit from the new craze surrounding memecoins. Ordinals are benefiting from a renewed rush for NFTs, reminiscent of developments around the turn of 2021/2022.

Last week, the auction house Sotheby’s sold three ordinals, each of which fetched six-figure sums. Experts had previously estimated their value at $20,000 to $30,000 each.

Stay tuned for daily cryptocurrency news!

The work of art “S” from the “BitcoinShrooms” collection brought in the record amount with sales proceeds of $240,000. Since then, many investors have considered Ordinals to be a gold mine.