Bonk (BONK) Price Prediction 2025–2030: Can BONK Hit New Highs?

Yes, if Bonk reclaims and sustains structure above 0.000027, technical models outline a clear path toward 0.000033–0.0000397 in 2025. The 0.000021–0.000024 zone is the key liquidity area wherein support, historical memory, and orderbook clusters meet. Holding this zone keeps the broader cycle biased upward.

In the meantime, the meme-driven liquidity of Solana

SOL

-1.12%

continues to expand, with DEX rotation really heating up across retail flows. BONK

BONK

-1.74%

benefits from consistent turnover and deeper pools than other Solana memes, giving it stronger resilience during market volatility; conditions like this often precede phases of accelerated price movement.

When 0.000027 flips into support, several forecasting models converge to suggest upward continuation. Convergence from CoinCodex, Changelly, CoinPaper, CryptoNews, and 99Bitcoins offers a unified look at BONK’s multi-year trajectory; such agreement across models bolsters confidence in its 2025-2030 outlook.

| TL;DR: – BONK is currently consolidating between 0.000022 and 0.000025, testing the 0.000027 barrier for a breakout. – Models project a 2025 target zone of 0.0000268–0.0000397 if BONK closes firmly above resistance. – 2026 will likely form a steady consolidation base before deeper liquidity returns. – 2027-2028 depicts the expansion and volatility phases in the mid-cycle dynamics of Solana. – In 2030, long-term projections cluster in the range from 0.00010 to 0.000178 under maturing network growth. |

Bonk (BONK) Price Prediction 2025–2030

| Year | Forecast Range ($) | Mean ($) | Source | Evaluation | Verdict |

|---|---|---|---|---|---|

| 2025 | 0.0000268 – 0.0000397 | 0.000033 | CoinCodex | Realistic short-term projection tied to Solana liquidity | Reasonable |

| 2026 | 0.00002422 – 0.00002648 | 0.00002533 | Changelly | Fits post-rally cooling phase, moderate but coherent | Conservative but valid |

| 2027 | 0.000037 – 0.000051 | 0.000044 | CoinPaper | Mid-cycle expansion driven by improving Solana throughput | Plausible |

| 2028 | 0.000040 – 0.000080 | 0.000060 | CryptoNews | Wide band reflecting volatile meme liquidity within SOL | Reasonable–Aggressive |

| 2029–2030 | 0.00010 – 0.000178 | 0.000139 | 99Bitcoins | Long-term compounding path built on ecosystem growth | Aggressive but possible |

2025: Breakout Confirmation Year (0.0000268–0.0000397)

2025 is the confirmation year in which BONK can advance toward 0.000033–0.0000397 if it successfully reclaims and holds above the 0.000027 breakout level.

CoinCodex projects a range of 0.0000268–0.0000397 with a mean around 0.000033. This is in line with the previous early-cycle performance of BONK during Solana expansion phases.

Once BONK holds above 0.000024 and reclaims 0.000027, liquidity rotation could quickly push the asset toward the upper range. As Solana’s throughput goes up, so does the volatility of meme assets, which provides perfect conditions for acceleration in BONK.

Short-term retracements are expected, but losing the 0.000021–0.000022 band would be required to break the structural bullishness. So long as BONK respects these support layers, targets for 2025 remain firmly intact.

2026: Expected Consolidation Phase (0.00002422–0.00002648)

2026 is expected to be a consolidation year, keeping BONK within the 0.00002422–0.00002648 range as the market stabilizes after the previous breakout. Changelly forecasts an average of 0.00002533, consistent with typical corrective structures after expansion phases in meme-driven markets.

BONK creates higher lows-in other words, it allows the market to reset liquidity and rebuild stronger support. The maturation of the Solana network contributes to steadier flows, dampening excessive short-term volatility. All such structural pauses help in long-term sustainability.

Although less explosive compared to other years, 2026 sets the stage for more aggressive moves later. Historically, BONK’s resilience during consolidation is a signal of readiness for the next expansion phase.

2027: Mid-Cycle Expansion on Solana 0.000037–0.000051

2027 marks the beginning of BONK’s mid-cycle expansion, with projected movement toward the 0.000037–0.000051 zone as Solana enters its acceleration phase.

According to CoinPaper, BONK’s midpoint forecast sits around 0.000044. Strong retail recognition and deep liquidity make BONK a consistent outperformer during Solana throughput surges.

With high liquidity and strong retail recognition, BONK tends to outperform as Solana throughput increases. Upgraded infrastructure and a rise in DEX participation usually boost the volatility of meme-assets. These conditions set the stage for BONK to return to higher valuation zones.

Institutional curiosity in the efficiency of Solana may also indirectly favor BONK. Listings, integrations, or ecosystem incentives anchor price momentum and reduce downside risk during the 2027 expansion window.

2028: High-Volatility Upside Window (0.000040–0.000080)

2028 opens a high-volatility window for BONK, widening its expected range to 0.000040–0.000080 as late-cycle liquidity increases across Solana markets. CryptoNews projects a midpoint of 0.000060, reflecting the volatility typical of meme assets in late-cycle environments.

BONK usually sees sharp expansions during high-volatility years, immediately followed by swift retracements.This is typical for meme-driven cycles dominated by retail and speculative capital. Stronger DEX liquidity helps regulate downside and provides substantial upside continuations.

Thus, if Solana continues to have strong user activity, BONK might start to trend into the higher range of this forecast. Market catalysts like network upgrades and liquidity unlocks might strengthen upward price pressure.

2029–2030: Long-Term Fair-Value Zone (0.00010–0.000178)

2029–2030 represent BONK’s long-term fair-value phase, where maturing Solana adoption supports a valuation range of 0.00010–0.000178.

According to 99Bitcoins, BONK’s long-term average sits around 0.000139, assuming compounding demand, ecosystem expansion, and broader liquidity availability across both CEX and DEX venues.

As Solana continues to develop its institutional presence, the underlying liquidity for BONK should be further strengthened across both centralized and decentralized venues. This can help to reduce volatility, yet maintain upside elasticity-all part of mature meme-asset dynamics from earlier market cycles.

Though the upper boundary is aggressive, historical volatility for BONK makes such outcomes statistically possible. Sustained network growth and consistent liquidity flow are important anchors for this long-term trajectory.

On-Chain & Flow Check for Bonk Price Prediction

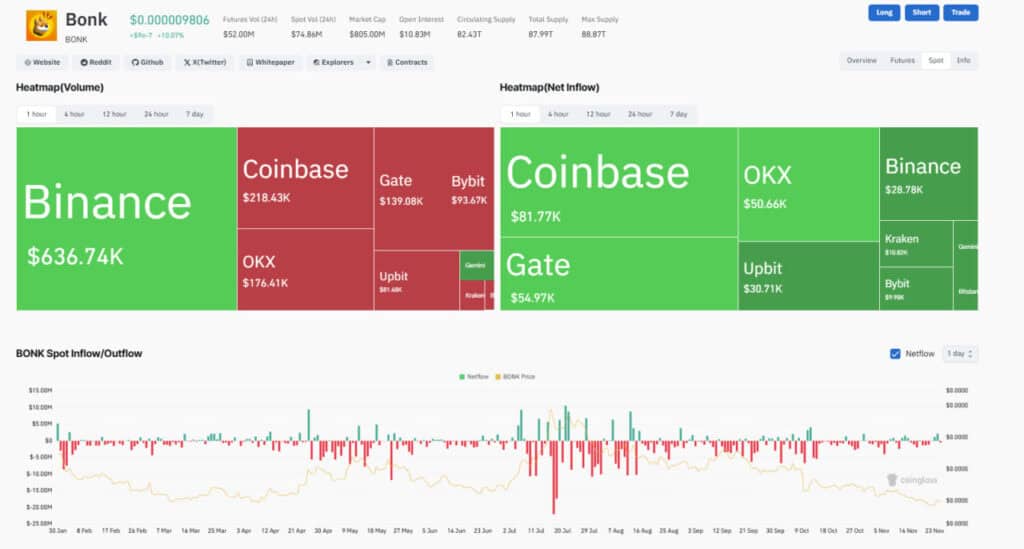

Bonk’s volume heatmap indicates that Binance leads in trading volume at 636.74K, far above Coinbase at 218.43K and Gate at 139.08K. This suggests that Binance remains a speculative center wherein rapid rotations shape the short-term structure.

In the net inflow heatmap, the structure is different, where Coinbase posts 81.77K in inflows, followed by Gate at 54.97K and OKX at 50.66K. Despite volume remaining high, Binance inflows remain relatively modest at 28.78K, suggesting that accumulation is heavier on U.S. and Korean exchanges.

The Spot Inflow/Outflow chart reveals several red outflow bars, each in the negative range of five million to ten million for recent rotations. BONK’s price remained consistent through these outflows, which pinned sellers were exiting while supply left exchanges. Should this outflow pattern continue, BONK could revert quickly into alignment with its upper-range targets for 2025–2028.

KOL Lens: Lark Davis (YouTube)

Lark Davis explains that usually, meme assets on Solana accelerate faster whenever network throughput increases. The analyst highlighted that BONK is the most liquid meme token in Solana and hence has a natural advantage during market rotation.

Davis, in his analysis, says this because structural reclaim levels often define momentum paths for high-velocity assets. For BONK, the equivalent trigger aligns with the 0.000027 region, which has historically mirrored patterns that preceded rapid price extensions.

Davis further comments that strong DEX rotation and exchange supply tightening strengthen the BONK medium-term outlook. Generally, when liquidity clusters start facing the Solana meme sector, BONK always reacts with increased volatility.

Conclusion

BONK approaches one of the most important structural pivots. A confirmed reclaim of 0.000027 activates the 0.000030–0.000038 channel and reinforces the broader cycle trend. Sustaining the 0.000021–0.000024 accumulation zone remains key to avoiding deeper resets.

Through 2026–2028, BONK’s projection bands widen in tandem with the liquidity cycles of Solana. These years reflect distinct phases that have historically supported the strongest expansions of BONK. Long-term estimates clustered around 0.00010–0.000178 suggest significant upside potential under a maturing ecosystem.

If Solana continues to grow, BONK is one of the highest-elasticity assets in the ecosystem with asymmetric risk-to-reward dynamics.

Frequently Asked Questions

1. Will BONK reach 0.000035–0.000040 in 2025?

Yes, if BONK breaks and holds above 0.000027, multi-model data supports an increase in the price towards 0.000033–0.0000397.

2.What nullifies BONK’s bullish structure?

A loss of the 0.000020 support increases the chance of a retrace toward 0.000017–0.000018.

3. Do on-chain flows support the bullish view?

Yes, exchange outflows along with increasing DEX participation are indicative of supply tightening and improving demand.

4. What is BONK’s target for 2030?

Long-term models converge in the 0.00010–0.000178 fair-value band, depending on the strength of Solana adoption.

| Disclaimer The information provided in this article is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency and blockchain markets are volatile, always do your own research (DYOR) before making any financial decisions. While TokenTopNews.com strives for accuracy and reliability, we do not guarantee the completeness or timeliness of any information provided. Some articles may include AI-assisted content, but all posts are reviewed and edited by human editors to ensure accuracy, transparency, and compliance with Google’s content quality standards. The opinions expressed are those of the author and do not necessarily reflect the views of TokenTopNews.com. TokenTopNews.com is not responsible for any financial losses resulting from reliance on information found on this site. |