Dogecoin (DOGE) Price Prediction 2025–2030: Can DOGE Reach $1?

Yes, provided Dogecoin defends 0.13–0.15 structural support and reconquers the 0.21–0.25 resistance, models outline a clean upside path toward 0.40–0.80 going into 2026. ETF-driven liquidity from the REX Osprey DOGE ETF strengthens demand. Meme rotation continues to reinforce early-cycle structure.

At the same time, network activity is growing sharply, with repeated spikes above 120,000–150,000 active addresses. Whale accumulation around 0.21 follows the historical pattern of an engagement peak preceding a strong impulsive move. These flows mirror early phases of prior meme uptrends.

Long-horizon forecasts from CoinCodex, Changelly, Coinpedia, Finder, and Benzinga create a wide but consistent 2030 corridor of 0.40–3.00 USD. A blended midpoint of 1.30 USD emerges across models. DOGE therefore remains a high-variance but structurally supported asset under ETF and meme dynamics.

| TL;DR: – DOGE trades near 0.15 with a strong demand base at 0.13 to 0.15 and ETF-supported liquidity. – A reclaim of 0.21–0.25 would unlock the 0.30–0.36 band, with 0.40–0.80 possible into 2026. – Below 0.13, price risks a retest toward 0.10–0.12 before any rebound. – Models for 2030 range from 0.40-3.00 USD, with a midpoint of about 1.30 USD among major forecasts. |

| The Dogecoin (DOGE) forecast below combines panel data from Finder, algorithmic curves from Benzinga and Changelly, technical-cycle modeling from CoinCodex, and ETF-driven scenarios from Coinpedia to outline a likely 2025–2030 path. |

Dogecoin Price Predictions 2025–2030

2025 As The ETF Reaction Year (0.1454–0.1909)

According to CoinCodex’s technically founded model, it is expected that Dogecoin will range from 0.1454 to 0.1909 USD in 2025. The yearly mean at 0.1689 USD reflects controlled recovery around the 0.13–0.15 demand floor ETF inflows may push short-term volatility but do not alter the core baseline.

According to CoinCodex, the narrower projection for 2025 underlines structural support, not speculative extensions. The trend-like behavior of DOGE supports such slow and steady rebuilding in ETF launch phases. This is in line with past early-cycle patterns where demand stabilized before expansion.

Speculative spikes toward 0.30–0.40 remain possible under stronger meme rotation. However, these upside moves lie outside the conservative framework and depend on liquidity surges rather than the continuation of any trend.

2026 Would Be the Meme Consolidation Year (0.165–0.264)

The year 2026 is likely to become a consolidation phase after 2025’s ETF-driven swing. Changelly places DOGE between 0.165 to 0.264 USD, with the mean around 0.264 USD, which marks a mild continuation channel. This follows meme-asset norms, where post-inflow digestion precedes deeper cycles.

Changelly methodology focuses on algorithmic slope modeling, emphasizing sustainable patterns of liquidity. The range represents structural calm during a year in which momentum has reset. Traditionally, DOGE grinds upward modestly during mid-cycle years.

Temporary overshoots are possible if retail sentiment re-emerges, but core models keep a disciplined consolidation-first trajectory. This makes 2026 a rebuilding year, not an acceleration phase.

2027 Is Likely To Be Expansion Reignited (0.230–0.295)

Benzinga projects 0.230–0.295 USD for Dogecoin in 2027, framing it as a renewed expansion year driven by retail re-engagement and rising network activity. The 0.260 USD midpoint reflects steady trend growth rather than speculative excess.

According to Benzinga’s long-horizon trend model, DOGE benefits from improving liquidity conditions and recurring meme-cycle rotations. Their analysis highlights 2027 as a “re-acceleration window”, where social-market participation and whale activity often return.

A breakout above 0.30 USD would require stronger retail inflows and ETF-driven repositioning. Benzinga notes that while upside flexibility exists, the structural outlook favors measured expansion over parabolic rallies. This positions 2027 as a stable STABLE -3.40% growth year with room for moderate extensions.

2028 Institutional Maturity And Wrapped DOGE Phase (1.25–2.00)

2028 is the period of major revaluation, driven by institutional flows and wrapped-DOGE integrations. Coinpedia sets a band at 1.25–2.00 USD, averaging 1.75 USD, representing deeper development of ETF frameworks and cross-chain integrations. This would constitute the first potential structural leap in the cycle for DOGE.

Wrapped DOGE products, such as cbDOGE, amplify utility across DeFi environments. These serve to give DOGE wider exposure to financial infrastructure, boosting liquidity depth. Coinpedia’s model integrates these utility-driven factors directly into its construction.

ETF maturity, supply shrinkage on the exchanges, and institutional rotations continue to build a solid case for DOGE’s entrance into the higher valuation tier, setting up 2028 as a transformative year regarding long-term structure.

2029–2030 Fair-Value Equilibrium Window (0.40–3.00)

Finder’s expert panel gives a wide range of 0.40-3.00 USD for 2029-2030, reflecting the high-variance identity of DOGE as a meme asset. The blended midpoint, at about 1.30 USD, reflects balanced expectations between institutional stability and meme-cycle elasticity. This range remains the most statistically neutral.

The lower-bound outcomes assume meme fatigue and declining engagement. The upper scenarios depend on very strong cultural persistence, repeated rotations of memes, and ETF acceleration. For DOGE, the long-term volatility profile supports both ends of this spread.

While ETF adoption forms a structural backbone, retail enthusiasm shapes the upper bounds. This places DOGE in a broad long-term valuation window within such a dual-driver model.

Dogecoin Price Prediction Table

| Year | Forecast Range (USD) | Mean (USD) | Source | Evaluation | Verdict |

|---|---|---|---|---|---|

| 2025 | 0.1454 – 0.1909 | 0.1689 | CoinCodex | Technically grounded, underplays ETF/meme spikes | Conservative |

| 2026 | 0.165 – 0.264 | 0.2640 | Changelly | Algorithmic continuation path after 2025 move | Realistic base case |

| 2027 | 0.230 – 0.295 | 0.2600 | Benzinga | Expansion outlook built on retail + trend models | Moderate bullish |

| 2028 | 1.25 – 2.00 | 1.75 | Coinpedia | ETF + wrapped DOGE thesis in full swing | Aggressive but coherent |

| 2029–2030 | 0.40 – 3.00 | 1.30 | Finder | Wide uncertainty around meme longevity | High variance |

On-Chain & Flow Check For Dogecoin Price Prediction

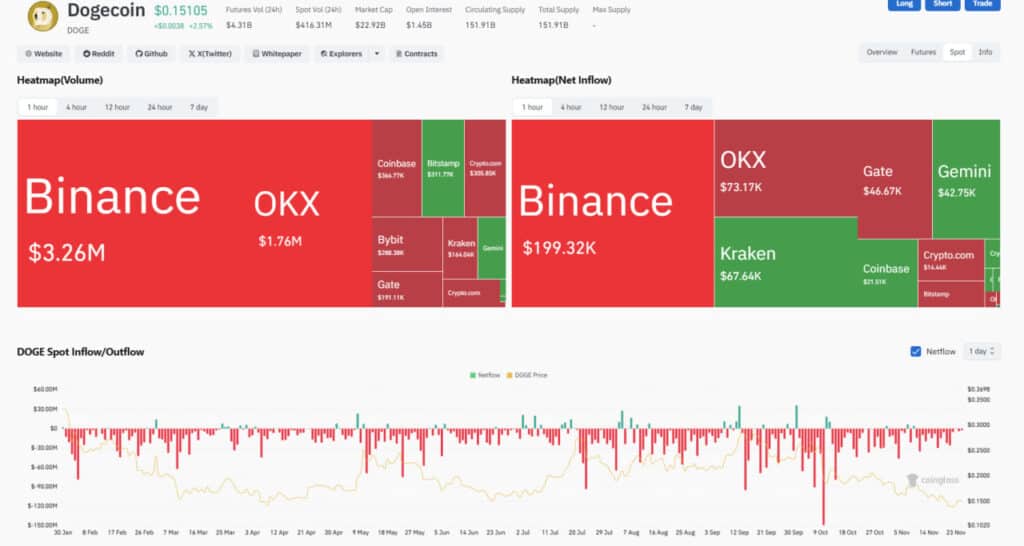

As depicted on CoinGlass, the spot netflow of Dogecoin still shows persistence in negative readings across major venues, which is a good indication of accumulation by stronger hands. Binance and OKX lead in terms of withdrawal footprints, and thus confirm the steady removal of liquid supply.

The Heatmaps show consistent outflow dominance, even during periods of increased trading volume. Structural participants continued to pull DOGE off exchanges, tightening available liquidity. This is generally how conditions form at the base of larger accumulative structures.

In 2025, when many spikes in deep outflow exceed -$60M, the accumulation narrative is reinforced. In such flows, if the price of DOGE remains in its demand zone of 0.13-0.15, then the setup for a trend reversal going into 2026 shall be stronger.

KOL Lens: Ali Martinez’s Dogecoin

Ali Martinez noticed a TD Sequential buy setup forming as DOGE defended 0.13–0.15. The signal came after sellers exhausted momentum in the recent declines. According to history, these reversals often precede early-phase meme recoveries.

He also pointed out that the rising active address count complements the TD setup. Engagement spikes during bottoming structures usually increase reversal probability. This setup is comparable to the turning points of past DOGE up-cycles.

This view is in line with multi-model forecasts that identify 0.21 as the first confirmation region, while above that DOGE targets 0.30–0.36 before testing 0.40–0.60 and possibly 0.75–1.00 under strong ETF flows.

Conclusion

Dogecoin stands at a pivotal junction around 0.15, supported by a 0.13–0.15 demand band and fresh structural interest from ETF and wrapped-token products. Above 0.21, attention shifts to the 0.36 resistance band, where a clear breakout could justify 0.40–0.80 targets into 2026 across several forecasting frameworks.

If those supports fail and price slips under 0.13, models reopen a deeper retrace toward 0.10–0.12 before any renewed attempt to reclaim the 0.20–0.30 zone. Over a longer horizon, synthesized projections from Finder, Benzinga, CoinCodex, Changelly and Coinpedia still cluster around a 2030 corridor of 0.75–2.50, with outliers both above and below that frame.

Dogecoin therefore remains a high-variance bet on meme culture, network activity and ETF adoption, rather than a low-volatility store of value. Position sizing, risk control and time horizon selection matter far more than any single point forecast.

FAQs

Will Dogecoin hit 1 USD by 2030?

Coinpedia projects a 2.50–3.00 range by 2030, while Finder’s panel aims for about 2.02 USD, so a 1 USD tag falls inside the bullish camp. Algorithmic models from Benzinga and CoinCodex stay lower, meaning that 1 USD requires strong meme cycles and sustained ETF inflows rather than only passive drift.

What invalidates the bullish DOGE view?

A decisive weekly close below 0.13 would signal that the long-term demand zone has failed and that ETF plus meme flows are not absorbing supply. Deteriorating active address counts and extended periods of positive spot netflow into exchanges would also argue for a deeper mean reversion rather than continuation.

How do on-chain flows look for DOGE?

Recent research highlights sharp spikes in active addresses plus whale accumulation on major dips, paired with occasional inflow surges when price approaches resistance. That combination suggests a tug of war between long-term holders and short-term traders rather than one-way capitulation.

What is the 2030 outlook for Dogecoin?

Across major platforms, 2030 forecasts span roughly 0.40–3.00 USD with a blended midpoint near 1.30. Lower outcomes assume meme fatigue and limited real-world usage, while higher paths depend on sustained ETF growth, merchant integration and repeated social media driven supercycles.

| Disclaimer The information provided in this article is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency and blockchain markets are volatile, always do your own research (DYOR) before making any financial decisions. While TokenTopNews.com strives for accuracy and reliability, we do not guarantee the completeness or timeliness of any information provided. Some articles may include AI-assisted content, but all posts are reviewed and edited by human editors to ensure accuracy, transparency, and compliance with Google’s content quality standards. The opinions expressed are those of the author and do not necessarily reflect the views of TokenTopNews.com. TokenTopNews.com is not responsible for any financial losses resulting from reliance on information found on this site. |