Dogecoin Price Analysis: Can DOGE Hold Momentum as Liquidity Shifts?

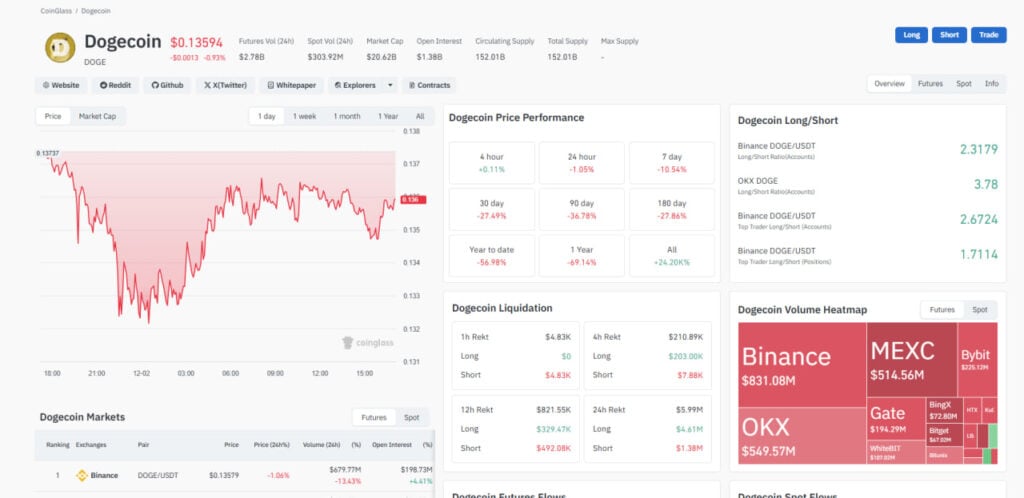

Directional momentum for DOGE is weakening, and a volatility expansion could occur as liquidity tightens and leverage increases. Currently trading at nearly 0.1359 USD, DOGE continues to reside in an area of compression where mixed spot and derivatives flows are making the market disproportionately responsive to minor changes in volume.

Open interest at 1.39B USD is indicative of high leverage, which increases liquidation risk and amplifies sensitivity in market sentiment. Now, the clearest signals that determine whether DOGE will stabilize or enter a higher volatility phase are real-time indicators: Long/Short ratio, Spot Netflows, and liquidation activity.

| Key Highlights: – DOGE trades around 0.1359 USD with active liquidity across spot and futures markets. – Open interest of 1.39B USD suggests a leveraged market that is prone to liquidation cycles. – The Long Short ratio exhibits slight buyer advantage, while mixed Netflows reflect hesitation across market participants. |

Market Overview and Liquidity Conditions

DOGE remains in an increasingly tight liquidity environment, with prices showing a high sensitivity to small changes in flows. The price continues to compress within an increasingly narrow zone as both spot and derivatives activity are showing inconsistent participation.

Leverage keeps on rising; futures flows remain core to the formation of short-term momentum. The bottom line is that traders track derivatives positioning closely because this often reflects shifts in sentiment.

Real-time indicators continue to guide short-term expectations, especially net-flows and long/short positioning, which often reveal directional pressure before price reacts.

| Metric | Value |

|---|---|

| Price (Spot) | 0.1359 USD |

| Market Cap | 20.62B USD |

| Circulating Supply | 152.01B DOGE |

| Total Supply | 152.01B DOGE |

| 24h Spot Volume | 303.92M USD |

| 24h Futures Volume | 2.84B USD |

| Open Interest (Futures) | 1.39B USD |

| CoinGlass data shows active participation across both markets. Spot volume reflects real interest from traders while futures volume and OI confirm that leverage continues to play a central role. These conditions often precede periods of expanded volatility. |

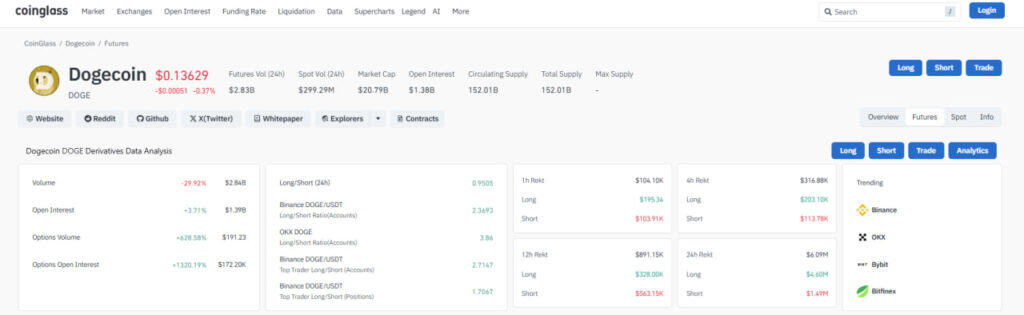

Derivatives Positioning and Volatility Risks

High leverage and high open interest indicate that DOGE is positioned for volatility expansion. While 2.84B USD in 24h futures volume and 1.39B USD in OI indeed show high market exposure to forced liquidation events during even a modest price move.

Liquidation clusters have appeared on both sides, signaling indecision and rapid sentiment switches. Funding rates and Long Short ratios are important to monitor as they will highlight where directional pressure is building before breakouts or breakdowns occur.

When leverage is increasing and price is staying compressed, volatility usually follows. DOGE is now positioned where new order flow could quickly extend the trading range.

Spot Liquidity and Flow Signals

Spot liquidity continues to structurally support DOGE even amidst broader market weakness. The spot volume near 299.31M USD demonstrates real underlying trading interest, which would limit deep intraday declines, particularly at times when derivatives markets become unstable.

Dogecoin’s fixed supply growth and predictable issuance reduce dilution shocks, helping to maintain stability during consolidation phases. Stable STABLE -3.40% token behavior also sets the stage for recovery attempts once demand reappears.

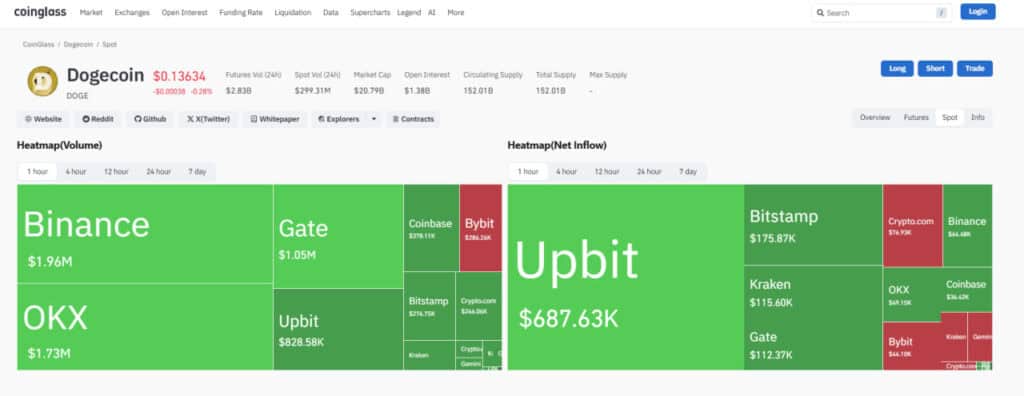

The Spot Netflow charts reflect changing negative and positive sessions, proof that the market is not strongly convicted. Negative flows have aligned with recent price drops, while positive inflows often catalyze short-term bounces.

Spot liquidity continues to support DOGE, with strong activity concentrated on major exchanges. The 1-hour volume heatmap shows Binance at 1.96M USD, OKX at 1.73M USD, Gate at 1.05M USD and Upbit at 828.58K USD. These levels indicate that DOGE maintains deep and stable liquidity across top markets.

Net Inflow data highlights Upbit as the strongest buyer with 687.63K USD in positive flow. Bitstamp, Kraken, Gate, Binance and OKX also show positive inflows, reflecting mild accumulation across multiple platforms. Red inflows from a few exchanges such as Crypto.com and Bybit are small and do not outweigh overall buying pressure.

Will DOGE Sustain the Impetus?

DOGE can maintain momentum only if the spot inflows strengthen and leverage unwinds gradually. Otherwise, the market risks entering a volatility expansion driven by liquidation chains.

High OI makes it particularly vulnerable in cases of a surprise dip in price, and such compressed price action often accelerates these liquidation cycles. DOGE usually moves to nearby support levels during unwinds of leverage and then attempts a recovery.

Spot liquidity remains the key stabilizer.

- Spikes in spot volume often signal early trend reversals before price fully shifts.

- Strong inflows absorb shocks.

- Stable tokenomics reduce dilution-driven pressure.

| Disclaimer The information provided in this article is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency and blockchain markets are volatile, always do your own research (DYOR) before making any financial decisions. While TokenTopNews.com strives for accuracy and reliability, we do not guarantee the completeness or timeliness of any information provided. Some articles may include AI-assisted content, but all posts are reviewed and edited by human editors to ensure accuracy, transparency, and compliance with Google’s content quality standards. The opinions expressed are those of the author and do not necessarily reflect the views of TokenTopNews.com. TokenTopNews.com is not responsible for any financial losses resulting from reliance on information found on this site. |