Is Noomez Safe to Invest In? An Expert Look at the Locked Liquidity and Team Vesting Schedules

| Disclaimer: The text above is an advertorial article that is not part of tokentopnews.com editorial content. |

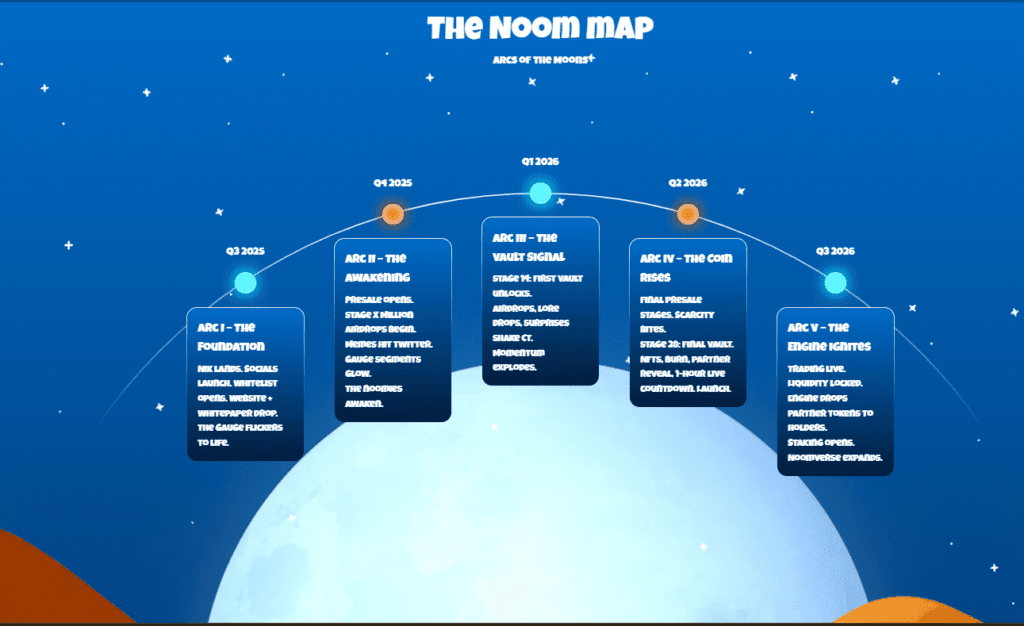

With presales launching daily and rug risks still prevalent, many early-stage buyers are asking the same question: is Noomez safe to invest in? The project, now in Stage 2 at a price of $0.000012320, is gaining attention for its transparent setup.

Liquidity is locked, team wallets are fully vested over 6 to 12 months, and all supply mechanics are verifiable on-chain. Unlike typical meme coins that offer little more than branding, Noomez has committed to a presale model governed by audited contracts and irreversible token burns.

For traders evaluating early entries, Noomez stands out as one of the few presales built with visible safeguards.

Understanding the Noomez Liquidity Lock

When asking is Noomez safe to invest in, one of the clearest answers lies in the project’s liquidity lock.

15% of all NNZ tokens are secured through a third-party service before launch, preventing any chance of funds being pulled once trading starts.

This step shields investors from the usual rug-pull risks that often appear in new launches.

Noomez also lists every lock detail publicly on its dashboard, so anyone can check the amount and duration themselves.

With team tokens vested for up to 12 months, both early buyers and long-term holders gain confidence in a project built on visible action, not promises.

Inside the NNZ Presale Risk Assessment

Every investor knows that presales carry some risk, but Noomez has taken clear steps to minimize it.

The project uses transparent on-chain mechanics to track each phase, giving buyers the ability to verify progress directly.

Each presale stage burns any unsold tokens, creating deflation while removing the risk of hidden supply dumps later.

Contract audits are publicly announced before launch, showing that Noomez treats verification as a necessity, not an afterthought.

Key security points:

- Unsold tokens burned after every stage

- Team wallets vested for 6–12 months

- Contract audit reports published before launch

- Liquidity locked through a verified provider

Fun Fact: The Noom Gauge lets traders watch the presale fill up live, making it one of the few launches where buyers can actually see their investment contributing to real-time progress.

These measures make Noomez a standout among modern presales.

Practical Crypto Presale Safety Tips from Noomez

Investing early can be rewarding, but it also means knowing how to spot a safe project.

Noomez shows what proper crypto presale safety tips look like in practice. It keeps liquidity locked, team tokens vested, and every transaction visible on-chain.

These steps prevent common exit scams and keep investor funds secure.

Pro Tip: Always check for time-locked liquidity and audited smart contracts before joining any presale.

If the team hides this information, that’s a red flag. Noomez makes all of this data public, setting a standard for how transparent projects should operate.

Why Noomez Is Viewed as a Safer Bet by Traders

Traders looking for low-risk presales often point to Noomez as an example of how structure and visibility can protect early investors.

The project combines long-term planning with verifiable security layers, all of which can be checked directly through its dashboard.

Instead of vague promises, Noomez provides hard data and proof of execution.

What stands out:

- Liquidity locked before launch and publicly viewable

- Team tokens vested for 6–12 months

- Transparent contract audits shared ahead of listing

- Deflationary system that prevents supply inflation

For investors looking for the next 100x crypto, Noomez stands out for its discipline and accountability, showing that safety and growth potential can exist side by side.

For More Information:

Website: Visit the Official Noomez Website

Telegram: Join the Noomez Telegram Channel

Twitter: Follow Noomez ON X (Formerly Twitter)

| Disclosure: The content below was paid for and produced by a third party. It does not represent editorial content and should not be considered financial or investment advice. |