Solana (SOL) Price Prediction 2025–2030: Can SOL Reach $1,000?

Yes, in the event that the Solana price secures a sustained move above the 240 USD resistance band, current technical signals and shifting on-chain flows indicate that a potential advance toward the 270-320 region is possible during 2025. The 198 to 210 support cluster continues to act as a critical reaction zone where major liquidity pockets and historical demand levels tend to interact.

Also, the accumulation patterns across centralized exchanges strengthen this outlook, where more SOL is consistently being withdrawn than deposited. A reduced circulating supply usually appears in advance of periods of accelerated price movement, especially at times when network activity rises hand in hand with growing developer and user participation.

A confirmed breakout above 240 would place Solana

SOL

-1.89%

in alignment with the projected 2025 price band centered around 270 to 320. According to forecasting models, such a move would fit within the broader continuation structure seen in prior growth phases across high-performance L1 ecosystems.

| TL;DR: – Solana is consolidating near the 220 region with a breakout above 240 opening a path toward 280 to 320 in 2025. – Multi-model forecasts project 210 to 320 in 2025, 300 to 480 in 2026, and a broader 360 to 600 expansion in 2027. – Institutional narratives begin influencing SOL from 2028 onward with long-term projections converging around 650 to 1050 by 2030. – On-chain and exchange-flow data show declining liquid supply that supports a bullish long-term scenario. – Failure to hold the 190 to 200 region could reset price to the 150 to 170 demand zone before recovery. |

Solana (SOL) Price Prediction 2025–2030

2025: Confirmation Year (210 to 320)

According to CoinCodex, Solana should continue to stay within the 210 to 320 price range in 2025, positioning the average forecast at approximately 265. The 240 resistance level remains the key resistance that will define whether Solana makes a move from consolidation into expansion.

Increased liquidity across the network supports the thought that a confirmed break above 240 can guide the market to the upper portion of the forecast. CoinCodex models indicate a more realistic balance between network strength and market volatility, hence closely corresponding to the underlying fundamentals of Solana.

A steady rise in sentiment, combined with decreasing sell-side pressure, reinforces the likelihood that 2025 will close more towards the mid-range projection. According to market structure, Solana continues to be well-positioned for continuation once buyers reclaim the key level.

2026: Consolidation Phase (300 to 480)

According to the forecast from Changelly, Solana is expected to move into a consolidation range of 300 to 480 in 2026. The year marks the normal cooling period after strong market growth, enabling liquidity to reset and build up a stronger base.

A mid-range value close to 390 coincides with historical patterns across major L1 cycles. Chains experiencing a strong upward move usually pause and rebuild momentum, with projected values that fit into this transition behavior.

The cycle structure remains consistent with prior recovery phases, suggesting that 2026 serves as the preparation period for renewed upside momentum. Market resilience improves through diminished volatility and resumed accumulation from deeper support levels.

2027: Expansion Reignited (360 to 600)

CoinCheckUp estimates that Solana will range between 360 and 600 USD in 2027, expecting renewed acceleration after the consolidation period of 2026. Technical indications and network-level developments back expectations of better performance.

Improvements to Validators, protocol refinements, and higher throughput in applications create a favorable environment than in the previous year. A mean forecast close to 480 reflects CoinCheckUp’s view that Solana re-enters a healthier expansion stage as liquidity returns to high-performance L1 assets.

Such continuation trends are supported by higher staking participation and reduced liquid supply. The forecast acknowledges these structural factors and is aligned with Solana’s capacity to attract capital in mid-cycle expansions.

2028: Institutional Maturity (450 to 720)

The projection by Benzinga sees Solana entering a broader institutional phase in 2028 and ranging between 450 and 720 USD. Institutional positioning strengthens once networks achieve consistent technical reliability and application traction.

Market conditions during this period favor high-throughput networks that have a mature ecosystem. A baseline projection of 585 represents a scenario wherein Solana maintains competitive throughput and consistent usage.

Ecosystem developments combine to bolster credibility, while infrastructure-level improvements support stable STABLE +0.06% , long-term growth compatible with Benzinga’s valuation band.

2029–2030: Long-Term Equilibrium (650 to 1050)

According to DigitalCoinPrice, the long-term projection for Solana in 2029 and 2030 is around 650 to 1050 USD. Multi-year growth trends suggest that structural expansion for Solana is intact, supported by rising user adoption and maturing protocol features.

A mean projection near 850 reflects the compounded performance seen in prior cycles. DigitalCoinPrice incorporates Solana’s historical growth rate, supply dynamics, and long-term network behavior into its valuation curve.

Continuous ecosystem growth combined with decreasing liquid supply provides a strong anchor for the long-term prediction. DigitalCoinPrice’s range aligns with expectations for a network moving into a mature infrastructure phase.

Solana Price Prediction Table (2025–2030)

| Year | Forecast Range ($) | Mean ($) | Source | Evaluation | Verdict |

|---|---|---|---|---|---|

| 2025 | 210 to 320 | 265 | CoinCodex | Realistic near-cycle projection with strong usage metrics | Reasonable |

| 2026 | 300 to 480 | 390 | Changelly | Logical post-rally cool-down forming a higher base | Conservative but valid |

| 2027 | 360 to 600 | 480 | CoinCheckUp | TA-driven expansion outlook with moderate optimism | Moderately Optimistic |

| 2028 | 450 to 720 | 585 | Benzinga | Institutional adoption thesis aligning with macro expansion | Plausible |

| 2029–2030 | 650 to 1050 | 850 | DigitalCoinPrice | Long-term adoption and CAGR-aligned model | Fair long-term target |

On-Chain and Flow Check for Solana

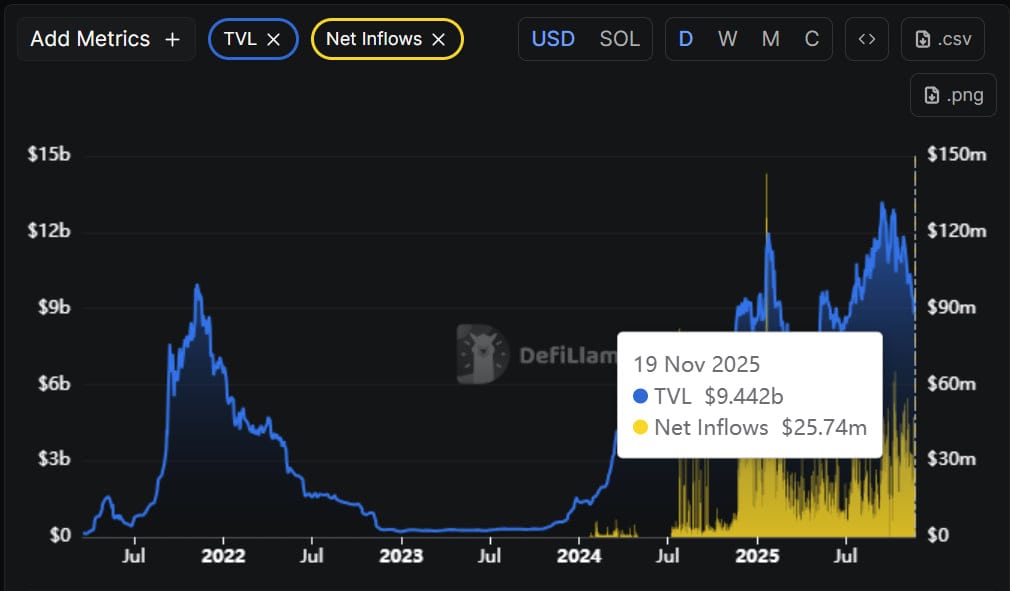

According to DefiLlama, Solana currently holds $9.42B in TVL, supported by strong on-chain activity across metrics such as DEX Volume, Chain Fees, App Revenue, and Active Addresses. The Net Inflows (24h) indicator has shown several consecutive periods of reduced inflows, which aligns with the continued drop in exchange-accessible liquidity.

From an on-chain perspective, lower exchange and protocol-adjusted supply historically tends to precede supply squeezes during demand acceleration. For Solana, this becomes increasingly important when network activity rises across segments such as Chain Revenue, Token Incentives, App Fees, and NFT Volume, while exchange balances continue to decline.

These conditions reflect a supportive environment for an upside continuation if the 240 USD resistance level flips into support. A successful reclaim of this level would combine tightening liquid supply with strengthening ecosystem activity, which has historically contributed to extended price expansions in previous Solana market cycles.

KOL: Lark Davis (YouTube)

Lark Davis points to a very important long-term structure on the Solana monthly chart. First, he notices that SOL is forming a cup and handle, a setup quite associated with major continuation phases.

In his analysis, the 1.618 Fibonacci extension lies at approximately the 425 USD level, which corresponds to the next major technical target if the pattern successfully completes.

He also states that the monthly MACD is currently forming a golden cross-a momentum signal that has tended to support sustained upside movement when confirmed on higher timeframes. This mix of structural pattern and long-term momentum cross firms up the bullish narrative.

Davis reckons that it gets even more interesting with the technical setup when there is possible Solana ETF approval, which could add dramatic capital inflows. If the pattern plays out as expected, he believes the long-term price trajectory for Solana could accelerate rapidly, especially as macro and institutional conditions turn favorable.

Conclusion

Solana is one strong weekly close away from confirming its next upward phase. A break above 240 activates the magnet zone at 270 to 320. A failure to hold the 190 to 200 support region increases the likelihood of a retest toward 150 to 170 before recovery.

All forecasting models show long-term projections converging between 650 and 1050 by 2030. As a function of rising developer activity, durable throughput, lower liquid supply, and expanding demand for fast blockspace, structural indicators cement Solana’s position as one of the highest-conviction L1 assets through the coming decade.

FAQs

1. Will Solana reach 300 in 2025?

Solana can reach 300 if the 240 resistance flips into support. Multi-model forecasts cluster around 270 to 320.

2. What invalidates the bullish 2025 setup?

A decisive break below 190 to 200 raises the probability of a deeper correction toward 150 to 170.

3. Is Solana’s on-chain demand still strong?

Yes. Declining exchange balances, stable fee revenue, and strong application activity support long-term growth.

4. What is Solana’s 2030 outlook?

Most long-term models place Solana in a 650 to 1050 fair-value range by 2030, driven by application growth and institutional participation.

| Disclaimer The information provided in this article is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency and blockchain markets are volatile, always do your own research (DYOR) before making any financial decisions. While TokenTopNews.com strives for accuracy and reliability, we do not guarantee the completeness or timeliness of any information provided. Some articles may include AI-assisted content, but all posts are reviewed and edited by human editors to ensure accuracy, transparency, and compliance with Google’s content quality standards. The opinions expressed are those of the author and do not necessarily reflect the views of TokenTopNews.com. TokenTopNews.com is not responsible for any financial losses resulting from reliance on information found on this site. |