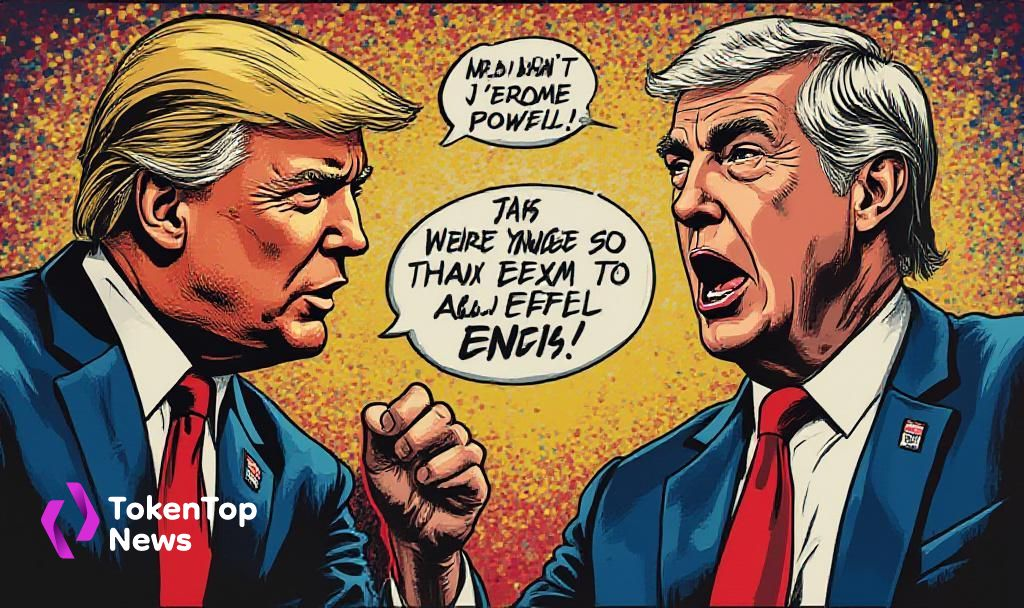

Trump Criticizes Powell Amid Fed Rate Decision

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Trump criticizes Fed’s current policy stance.

- Potential implications for U.S. economic and crypto sectors.

Donald Trump criticized Federal Reserve Chair Jerome Powell on social media after interest rates were left unchanged, blaming Powell for economic issues and poor management of Fed renovations.

This criticism signifies ongoing tensions impacting macroeconomic policy and potential volatility for digital assets, as market eyes shifts in the Fed’s stance.

Main Content

Trump and Powell: An Ongoing Clash

Donald Trump issued a critical statement against Federal Reserve Chair Jerome Powell after the Fed decided to keep interest rates unchanged. Trump described Powell as “Too Late, and actually, Too Angry, Too Stupid, & Too Political.” – CBS News

The controversy echoes past tensions during Trump’s presidency when he pushed for lower rates. Jerome Powell maintained his focus on inflation and the labor market, despite public pressures from the former president. – Fox Business

Impact on Markets

Trump’s remark underscores potential disruptions in investor confidence regarding U.S. economic policy. The Fed’s current caution may maintain higher volatility in risk assets, including cryptocurrencies. Macroeconomic policy shifts often impact digital asset trends.

Financial implications of this political climate could affect broader markets. The focus remains on how monetary policy decisions impact inflation and labor metrics, critical areas monitored by financial markets and cryptocurrency investors.

The Broader Monetary Debate

The ongoing dynamics between Trump and Powell illustrate the broader monetary policy debate. Analysts observe how monetary policy rhetoric may influence interest rates and crypto value. Powell’s stance on stablecoin regulation is seen as a potential driver for policy shifts.

Potential Fed leadership changes in future presidential elections could mean policy adjustments affecting both traditional and digital markets. Historical data suggests Trump-Fed tensions have previously led to market volatility, especially within crypto sectors, highlighting the impact of policy uncertainty.