XRP Price Prediction 2025–2030: Can XRP Break Long-Term Structure?

The price of XRP is expected to oscillate between $1.33 and $1.82 in 2025. By 2027, it should be heading toward the $2.33 to $3.45 range. It would then expand to $5.61 to $13.13 in 2028 and could surpass $26 by 2030 if long-term adoption accelerates.

Meanwhile, payment-related adoption is showing a gradual improvement as financial institutions test blockchain settlement tools. The positioning of XRP

XRP

-5.59%

within cross-border transfer infrastructure provides a very unique foundation for future utility-driven demand. Often, these dynamics in adoption accelerate when liquidity has stabilized and macro conditions begin to favor alternative rails.

If XRP manages to close above long-standing resistance clusters, multi-source forecasts from Changelly, CryptoNews, Coinfomania, PricePrediction.net, and Benzinga converge to a structured upward trajectory. This cross-model consistency underlines a constructive long-term outlook, extending into 2030.

| TL;DR: – XRP is consolidating inside the 0.55 to 0.60 zone and preparing for a challenge of the 0.70 breakout. – Forecasts for 2025 place XRP between 1.33 and 1.82 under steady recovery. – Larger expansions appear in 2027 and 2028 as adoption metrics strengthen. – A long-term projection by Benzinga projects XRP above $26 before 2030. – On-chain flows depict accumulation phases supporting price stability in the medium term. |

XRP Price Predictions 2025–2030

2025: Early Recovery Phase (1.33–1.82 USD)

Changelly estimates that in 2025, XRP will be trading between 1.33 and 1.82 USD with 1.57 being the central target.

With a successful reclamation of the 0.70 level that has capped prior rallies, XRP may approach this band. Liquidity rotation into payment-focused assets typically strengthens during mid-cycle recovery periods. Assets like XRP with an established utility role do well in such environments.

A sustained drop below the 0.55 support would weaken this forecast, although current accumulation trends remain constructive. The overall profile suggests a stable STABLE +2.35% setup leading into the next year.

2026: Gradual Growth Range (0.90–1.45 USD)

CryptoNews predicts XRP will fluctuate within the 0.90 to 1.45 USD corridor in 2026, with an anchor midpoint of 1.18.

During this period, XRP may gain from the growing testing activity of various payment corridors exploring blockchain settlement layers. These early integrations often amplify long-term resilience rather than immediate price surges and create a solid foundation for future acceleration.

A break below the lower boundary would signal macro weakness, while consistent closes near resistance bolster confidence for the following years. The forecast outlines a steady path ahead.

2027: Mid-Cycle Expansion Window (2.33–3.45 USD)

PricePrediction.net has predicted that XRP will rise into the zone of 2.33-3.45 USD for 2027, centered around 2.89.

XRP should particularly benefit if financial institutions begin to adopt blockchain rails for cross-border settlements. Greater use cases generally bring consistent demand that adds to upward price pressure. These events widen the scope of the projected band.

With increasing volatility, XRP can extend to the higher levels if market conditions stay positive. The price action could be kept within the midpoint region in case of delays in adoption.

2028: High-Expansion Phase (5.61–13.13 USD)

Coinfomania projects a wide range of expansion in 2028 of 5.61 to 13.13 USD, with an average estimate of 9.62 USD.

XRP tends to react very well when liquidity deepens across both on-chain and institutional channels. These phases tend to trigger high-momentum waves that expand valuations rapidly. The forecast indicates that XRP could enter a broader growth cycle in the period under review.

Failure to sustain the adoption traction may anchor the asset near the lower bound. Strong macro alignment supports the possibility of reaching the upper region of the projection.

2029–2030: Institutional Adoption Scenario (26.18–26.97 USD)

For 2029–2030, Benzinga outlines an institutional adoption path placing XRP between 26.18 and 26.97 USD.

The narrow band between 26.18 and 26.97 shows a focused long-term outlook based on infrastructure-level integration. These values reflect post-adoption pricing structures and not speculative cycles. The model shows what is possible when critical adoption thresholds are crossed.

But if adoption does stall, XRP will probably stay well beneath this valuation channel. Even so, the projection highlights what is possible for a fully realized utility network.

XRP Price Prediction Table

| Year | Forecast Range ($) | Mean ($) | Source | Evaluation | Verdict |

|---|---|---|---|---|---|

| 2025 | 1.33 – 1.82 | 1.57 | Changelly | Clear forecast for short-term recovery | Reasonable |

| 2026 | 0.90 – 1.45 | 1.18 | CryptoNews | Defined min–mid–max scenario | Conservative |

| 2027 | 2.33 – 3.45 | 2.89 | PricePrediction.net | AI-driven long-range curvature | Plausible |

| 2028 | 5.61 – 13.13 | 9.62 | Coinfomania | ML model with broad expansion range | Aggressive |

| 2029–2030 | 26.18 – 26.97 | 26.57 | Benzinga | High-end institutional adoption path | Very Aggressive |

On-Chain & Flow Check for XRP Price Prediction

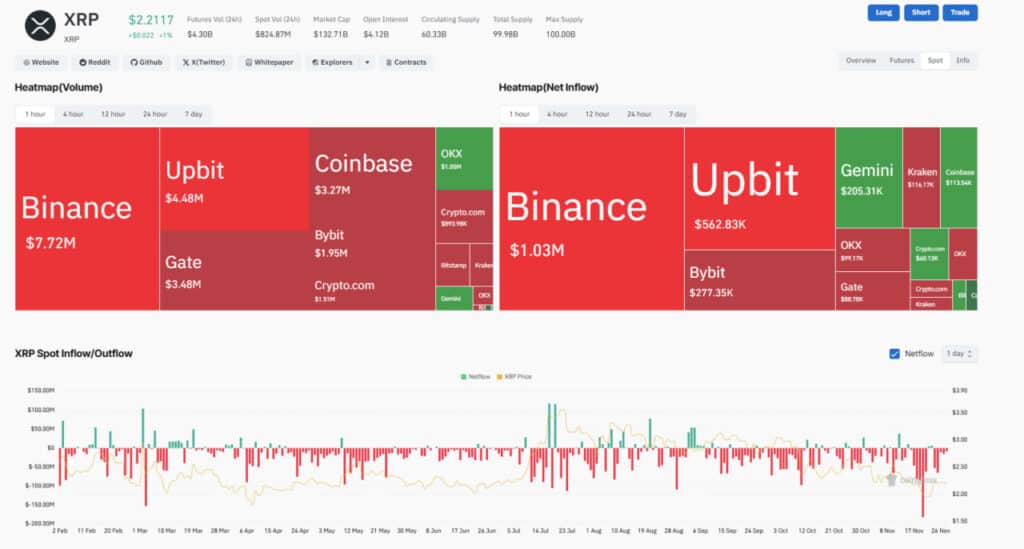

The XRP exchange volume map places Binance at 7.72 million USD, Upbit at 4.48 million USD, and Coinbase at 3.27 million USD. This distribution indicates strong liquidity concentration across majors. High-volume clusters contribute to supporting predictable price behavior in phases of high volatility.

Inflows chased by net inflow metrics put Binance at 1.03 million USD positive inflow, Upbit at 562.83 thousand USD, and Gemini at 205.31 thousand USD. These patterns paint a picture of renewed accumulation from both Asian and U.S. traders. Phases of accumulation normally precede medium-term breakouts.

Spot flow charts show recurrent outflows between 50 and 100 million USD during the big sessions. Despite the movements, XRP showed structural stability in the recent cycles. This means long-term holders are still absorbing the available supply.

KOL Lens: CoinsKid (YouTube)

CoinsKid explains that XRP is forming a massive compression pattern after months of sideways action. He also pinpoints how price is starting to push into key resistance levels that have kept momentum in check. This type of structural squeeze has often been seen before major breakout moves.

CoinsKid notices the 0.55-0.60 zone as the key base that needs to hold if a multi-month bullish structure is to be maintained. A confirmed push above nearby resistance would validate a higher-timeframe reversal, he said. He regards this reclaim as an entry signal for the next expansion phase.

CoinsKid adds that XRP historically moves fast once breakout structures are confirmed. Liquidity rotation tends to accelerate during these phases due to XRP’s previous impulse patterns. He considers current conditions a notable precursor to a significant long-term move.

Conclusion

XRP remains in place to reach a number of its multi-year projection ranges, which include 1.33 to 1.82 dollars in 2025, and possibly over 26 dollars by 2030, on condition that adoption continues to improve. This forecast underlines the structural support alignment, utility growth extension, and improved liquidity conditions at key venues.

So long as XRP remains in its long-standing base zones and reclaim targets are met, the asset has a constructive multi-year trajectory. Both conservative and aggressive projections have room for appreciation, pending rate of adoption and market stability.

XRP exhibits a balanced long-term setup as accumulation is visible in on-chain flows and technical compression tightens. Sustained execution in payment infrastructure and regulatory clarity will define the speed at which each forecast band is reached.

FAQs

Will XRP reach 1.50 in 2025?

Yes, if XRP holds its structural support and reclaims the 0.70 zone, the projected 1.33–1.82 band is realistic.

What invalidates the bullish view?

A breakdown below 0.50 weakens the structural setup and lowers probability of multi-year expansion.

How do on-chain flows look?

Netflows show active accumulation and reduced exchange supply, supporting medium-term strength.

What is the 2030 target for XRP?

Under an adoption-driven scenario, Benzinga places XRP around 26 USD.

| Disclaimer The information provided in this article is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency and blockchain markets are volatile, always do your own research (DYOR) before making any financial decisions. While TokenTopNews.com strives for accuracy and reliability, we do not guarantee the completeness or timeliness of any information provided. Some articles may include AI-assisted content, but all posts are reviewed and edited by human editors to ensure accuracy, transparency, and compliance with Google’s content quality standards. The opinions expressed are those of the author and do not necessarily reflect the views of TokenTopNews.com. TokenTopNews.com is not responsible for any financial losses resulting from reliance on information found on this site. |