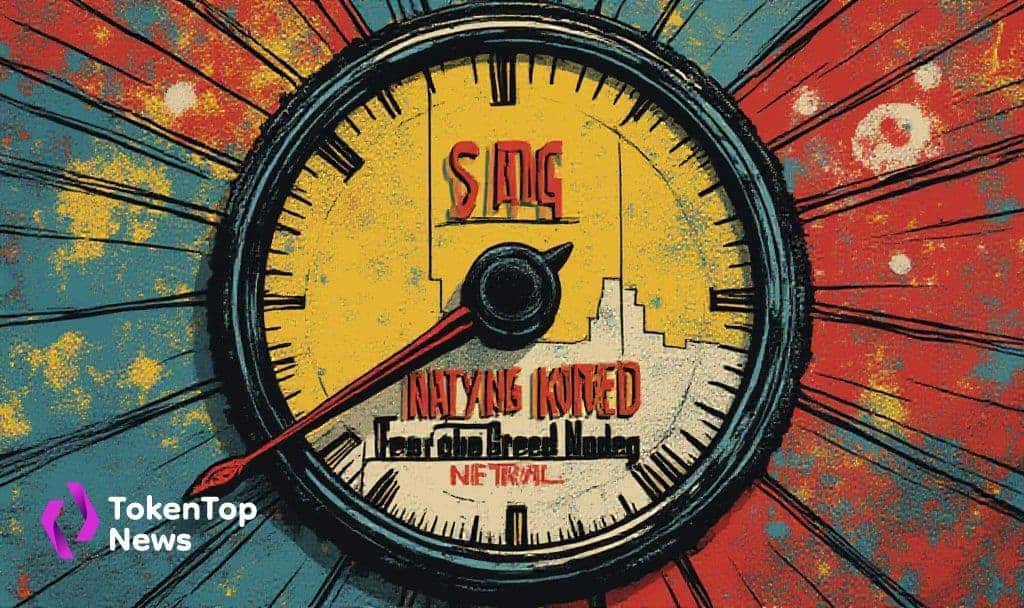

Crypto Fear & Greed Index Drops to Neutral 48

- The Crypto Fear and Greed Index is at 48, indicating neutrality.

- Sentiment is balanced with no clear bullish or bearish consensus.

- Market consolidation is expected following this neutral reading.

The Cryptocurrency Fear and Greed Index fell to 48 (Neutral) from September 17–20, 2025, indicating a balanced sentiment in the cryptocurrency market without a clear direction.

This neutral phase suggests market consolidation, impacting Bitcoin BTC +0.00% and Ethereum ETH +0.00% sentiment with no significant financial shifts or official reactions reported up to September 21, 2025.

The Crypto Fear and Greed Index recently dropped to 48, signifying a neutral market sentiment. This level suggests neither strong bullish nor bearish trader sentiment, causing market participants to anticipate further developments.

This index is primarily provided by Alternative.me, with wide amplification by platforms like Binance and CoinMarketCap. There are no key statements from index creators or major figures about the shift to 48 at this point.

The immediate effects on the cryptocurrency market show a stable STABLE +0.00% sentiment without significant volatility. The primary focus remains on Bitcoin, although sentiment generally impacts Ethereum and other leading altcoins.

No significant changes in fund allocation or market liquidity have been noted due to this neutral index reading, indicating market participants are currently observing and waiting.

The historical context shows the index recently ranged from Greed to Fear levels. Such neutral phases often herald periods of market consolidation, awaiting catalysts like regulatory or macroeconomic developments.

Previous extreme readings have shown potential for market fluctuations. A neutral index could lead to measured responses from traders, with historical trends indicating stability amidst regulatory caution or technological advancements.

Richard Teng, CEO, Binance, said, “Crypto Fear & Greed Index. 48. Neutral. Yesterday. Neutral.”