First edition of ARK Investments “The Bitcoin Monthly” is out

With the global economy showing all signs of a recession, the already weak bitcoin BTC -1.06% finds itself in a more uncertain macroeconomic environment.

The Terra crash was just JST +2.12% one of the warning signs.

ARK Investment is now publishing The Bitcoin Monthly, which details the performance of the leading digital asset. The May issue is now out. Ark Invest analyst Yassine Elmandjra explains the key takeaways from the first edition.

Bitcoin closed the month down 17.2%

It is the first time Bitcoin has recorded a ninth consecutive weekly decline, indicating an oversold condition. According to the ARK report, the Terra Network crash is one of the main reasons for this drop.The Fed’s announcement of interest rate hikes is another contributing factor. Bitcoin is still 67% off its peak reached in November last year. However, the report notes that 76% was the average drop from high to low in previous bear markets.

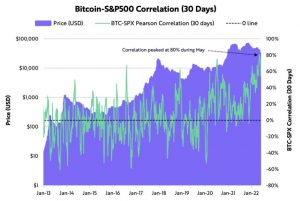

BTC and S&P 500 correlation hits new high

The report also notes that BTC’s correlation with the S&P 500 was 80% over the past month. This value is the highest correlation value Bitcoin has ever had with the S&P 500. This suggests that investors view Bitcoin as a risky asset.

However, the report also states that the strong correlation indicates massive market inefficiency. According to ARK investment analysts, Bitcoin’s fundamentals show that the correlation with the S&P 500 shouldn’t be that high.

Bitcoin has yet to break a major trend line

Despite the massive sell-off, Bitcoin is still trading above all major trend lines. It hasn’t fallen below its on-chain cost base of $24,000 or its 200-WMA of $22,000, unlike previous declines where the price has slipped below its on-chain cost base as well.However, it’s rare for him to close below his 200-WMA. However, the report states that the intersection of the lines between the $22,000 and $24,0000 area indicates strong support for Bitcoin. Elmandjra added that even if this bear market is like the previous ones, the downside risks are still on BTC’s 200-week WMA.

Terra crash wipes out 3% of total crypto market cap

ARK Investment Reports notes that Terra is the

largest layer-one blockchain failure in crypto history. The crash caused a $60 billion loss in the market cap of the UST stablecoin and LUNA token.The Mt. Gox hack of 2014 caused the crypto market cap to drop by 5.7% at the time. However, the recent Terra Network crash caused the crypto market cap to drop by 2.7%.

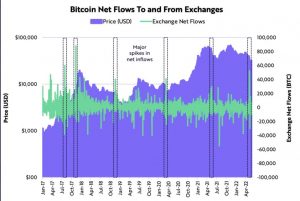

Stock market inflows peak

After the Terra crash, the daily Bitcoin inflow on exchanges reached 52,000 BTC. This is the highest value since November 2017. It is also the highest value ever measured in USD. The report notes that large net Bitcoin inflows typically occur during periods of high volatility.

This volatility can occur in both bull and bear markets. Another reason for the huge daily Bitcoin inflow to the exchanges was the sale of almost 80,000 Bitcoin by the LUNA Foundation Guard (LFG). The sale of LFG was part of a move to prevent its UST stablecoin from collapsing.