Aave stops lending with 17 Ethereum tokens

Aave stops lending 17 Ethereum tokens for security reasons after failed attack by a notorious trader. The dApp wants to prevent manipulation in this way.

Aave stops lending with Ethereum tokens

The decentralized lending protocol stops lending transactions with 17 different Ethereum tokens, according to a vote within the Aave Risk DAO . Twelve volatile cryptocurrencies are affected:

Yearn.finance (YFI), Curve Finance (CRV), 0x (ZRX), Decentraland (MANA), 1inch (1INCH), Basic Attention Token (BAT), Enjin (ENJ), Ampleforth (AMPL), DeFi Pulse Index (DPI ), RENFIL, Maker (MKR) and xSUSHI.

In addition, the lending of five stablecoins is stopped. These are: sUSD, Pax Dollar (USDP), Liquidity USD (LUSD), Gemini Dollar (GUSD) and RAI.

The dApp uses a freeze function to prevent business operations with said systems. The voting within the DAO is pretty clear with a result close to 100 percent.

Why does Aave stop lending with certain tokens?

The reason for the interruption is unclear market conditions.

As the market conditions for these assets are currently volatile, we recommend temporarily freezing the above markets as a precautionary measure.

It says in the justification of the application. However, this does not mean price fluctuations, but the existing liquidity . Aave froze assets in the Aave Ethereum V2 market that are under-numbered and/or under- capitalised .

This makes them vulnerable to manipulation. A potential attacker could then borrow at a profit at the expense of the dApp. The frozen tokens may be offered again at a later date in the Aave Ethereum V3 market.

This is characterized by technical improvements. Greater security should prevent such manipulation. But why is Aave taking this step now? In fact, a specific event is the occasion.

Notorious trader Avraham Eisenberg published an idea on how to exploit the decentralized lending protocol in October. In his comment, he sarcastically refers to Aave as “completely safe.”

On November 22, Eisenberg finally tested his idea himself. He used the Curve Token (CRV) and a deposit in the form of USDC. His plan fails and the trader’s wallet (0x57e04786e231af3343562c062e0d058f25dace9e) is left with a $10 million loss.

Nevertheless, Aave did not want to leave this option open any longer and started the said vote, which has now ended successfully. Despite the liquidation of the trader, the dApp records losses of $1.6 million.

Eisenberg recently hit the headlines after relieving the Solana-based dApp Mango Markets of 114 million Swiss francs.

How low is the liquidity of the affected tokens?

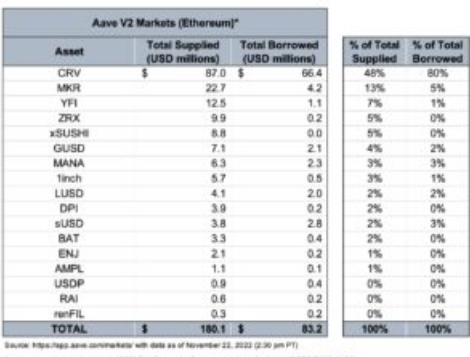

In the Aave forum, user RasterlyRock shares a table of attachments. It shows that the liquidity of the tokens ranges from $300,000 in the case of RENFIL to $87 million in the case of CRV.

The DAO assesses this liquidity as too low. Eisenberg took out about $60 million in CRV loans, which are noted in the stats.